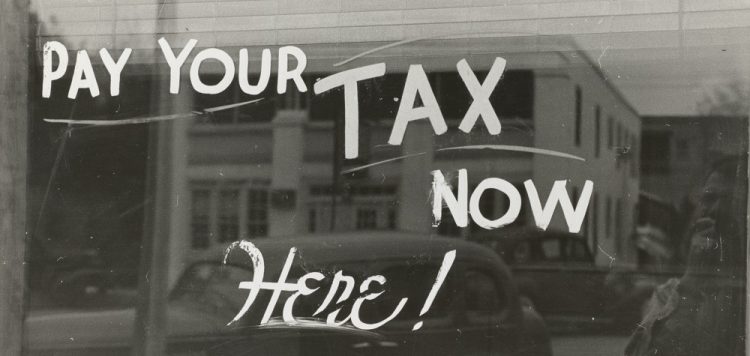

The sales tax laws for states within the United States are not subject to federal regulation. Each state has control over its base sales tax. Sales taxes are typically imposed on retail transactions and certain services. In addition to base sales taxes, certain municipalities and counties impose additional surtaxes. For example, the sales tax in New York State is 4%, but New York City has additional taxes making the rate 8.875%.

While certain goods such as groceries, prescription, non-prescription drugs, and clothing may be exempt from the state’s general sales tax, these same goods may be subject to local sales taxes.