The digital footprint of a legal professional often stretches back decades, creating a silent

The Evolution of Knowledge Management from Keyword Search to Intelligent Synthesis The transition

As a visionary leader at the intersection of law and technology, Byong Kim has spent years bridging the gap between traditional legal practice and cutting-edge digital transformation. Currently serving as the Chief Data and AI Officer at Seyfarth Shaw, he has moved from leading specialized

The modern law firm is no longer defined merely by its leather-bound volumes or its billable hour, but by the sophisticated algorithms that now hum beneath the surface of every deposition and contract negotiation. As we move deeper into this digital transformation, the legal sector is experiencing

State legislatures are currently grappling with an unprecedented influx of over one thousand

The rapid transformation of digital finance has reached a critical tipping point as states move

For decades, the contract drafting process has been a notorious bottleneck. Legal teams, buried in manual revisions and administrative tasks, have treated it as a necessary burden rather than a…

A single product announcement on February 3, 2026 exposed a fundamental misunderstanding of value

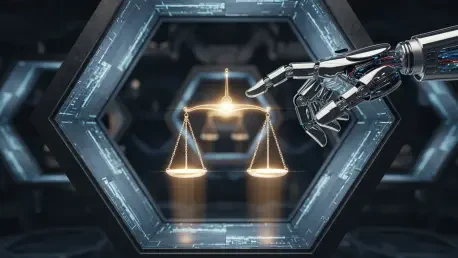

Governing AI Risk in the Modern Law Firm Recent studies reveal some sobering statistics for the law

The traditional "take-it-or-leave-it" approach to B2B data-sharing agreements has evolved, paving

In the corporate world, the terms "confidential" and "privileged" are often used interchangeably,

Navigating the Contradiction: Personal Utility and Legislative Action The invisible boundary between how a legislator lives behind closed doors and how they vote on the house floor has never been more visible than in today's fractured energy landscape. As the calendar turns further into 2026, the

The stillness that descended upon the El Paso International Airport at exactly 11:30 p.m. on a

The legal battle over Manhattan's traffic management has reached a definitive turning point as a