India is grappling with a significant rise in cybercrime incidents, highlighting the urgent need for enhanced security measures. Victims of such crimes often face severe challenges, not only in reporting these incidents but also in recovering their losses. The sophistication of criminals’ techniques has deeply exploited the public’s digital trust, adding a complex layer of difficulties that law enforcement and victims must navigate.

Rising Incidents and Financial Impact

Sharp Increase in Cybercrime Activities

Between January and April 2024, India experienced an alarming surge in cybercrime activities. Data from the Indian Cyber Crime Coordination Centre (I4C) indicated that financial losses during this period skyrocketed, exceeding Rs 1,750 crore, with more than 740,000 complaints registered. This represents a staggering 113.7% increase compared to previous years, signaling a growing and serious threat to India’s burgeoning digital ecosystem. The sharp rise underscores the urgent need for robust cybersecurity measures to protect the nation’s digital infrastructure and its citizens.

Personal Accounts of Victims

A 29-year-old architect, Anjali Singh, recently found herself entangled in a phishing scam that exploited her trust in her bank’s digital security. She received a meticulously crafted email that mimicked her bank’s security alerts, leading her to unwittingly disclose sensitive information. This resulted in unauthorized transactions that drained her account. Meanwhile, Shivani Mathur encountered an online investment scam through an Instagram ad, which lured her into a private Telegram group with promises of high returns. Tragically, she lost Rs 50,000 in what she initially perceived as a legitimate investment opportunity. These personal accounts underscore the real and growing dangers that many Indians face daily in their interactions with digital platforms.

Exploitation of Digital Trust

Increasing Reliance on Digital Platforms

The modern digital landscape, marked by an increasing reliance on online platforms for diverse activities, has inadvertently made users more susceptible to cyber threats. Cybercriminals have adeptly adapted to this digital dependency, employing sophisticated techniques to exploit users’ digital trust. One such method, known as “quishing,” involves embedding malicious URLs within QR codes found in emails, text messages, or even displayed on websites and posters. This tactic preys on the user’s lack of familiarity with QR code security, directing them to counterfeit websites designed to extract personal information or distribute malware. The growing dependence on digital technologies without a commensurate increase in security awareness amplifies these vulnerabilities, making individuals easy targets for cybercriminals.

Sophisticated Tactics by Cybercriminals

Beyond quishing, cybercriminals leverage a variety of sophisticated tactics to exploit users’ digital trust. These include advanced social engineering techniques that manipulate victims into divulging sensitive information or performing actions that compromise their security. For instance, criminals might impersonate trusted entities such as banks or government officials, using convincing messages to extract personal data or access credentials. The continuous evolution of these tactics complicates the cybersecurity landscape, underscoring the pressing need for increased user awareness and education. By equipping individuals with the knowledge to recognize and avoid these threats, we can help mitigate the risks associated with our digital dependency.

Predominant Cyber Fraud Methods

Investment Scams

Investment scams are among the most prevalent cyber fraud methods currently being employed by cybercriminals. Scammers often use social media platforms to identify potential victims, initially offering small but genuine returns to establish a sense of trust. This deceitful confidence-building tactic prompts victims to invest larger sums based on promises of higher returns, eventually leading to significant financial losses. Victims of these scams often find themselves entangled in a complex web of false promises and manipulated data, making it difficult to discern the scam until it’s too late. The emotional and financial repercussions of such scams can be devastating, leaving victims wary of future investment opportunities and significantly impacting their financial stability.

Work-from-Home Fraud

Since the onset of the COVID-19 pandemic, there has been a significant increase in work-from-home fraud schemes. These scams typically lure victims with offers of small payments for relatively simple tasks like product reviews. As victims engage and progress with the tasks, scammers introduce the concept of “premium” memberships that promise higher-paying assignments, which require an initial investment. As victims invest more, they are often met with additional requests for fees under various pretexts such as taxes or recommendations. These continued financial drains are cleverly disguised through a series of escalating yet seemingly reasonable demands, systematically depleting the victim’s resources. The pervasive nature of these scams exploits the economic vulnerabilities induced by the pandemic, targeting individuals seeking remote work opportunities.

Fake Official Requests

Another prevalent method is the use of fake official requests. Scammers pose as government officials or representatives from reputable organizations, asking victims to transfer funds to purportedly official accounts for various fraudulent reasons. One common ruse involves scammers posing as service providers from companies like LPG or utilities, sending urgent messages that prompt immediate payment through the provided fake links. These messages often carry an aura of authenticity, using official-sounding language and familiar branding to wield undue pressure on recipients. Such deceitful tactics not only defraud unsuspecting individuals but also undermine trust in legitimate digital communications from actual service providers.

Underreporting and Legal Challenges

Lack of Awareness and Skepticism

A significant issue compounding the cybercrime problem in India is the underreporting of these incidents, which is often fueled by a lack of awareness and a deep-seated skepticism among potential victims. Many individuals are unaware of the resources available to them, such as dedicated cybercrime helplines (1930 and 100), and therefore do not seek help. Additionally, there is a widespread perception that law enforcement agencies are ill-equipped to effectively handle cybercrime cases, a sentiment that is exacerbated by the sheer volume of complaints and the apparent backlog faced by authorities. This skepticism further diminishes public confidence in the possibility of legal redress, leaving many victims feeling helpless and reluctant to report their experiences.

Proactive Reporting and Legal Support

Despite increasing awareness around the issue, proactive reporting and robust legal support for cybercrime victims remain critical challenges. Gautam Sinha, CEO of fintech company LTFLoW, has emphasized the importance of such measures for minimizing the impacts of cyber fraud and fostering a safer digital economy. Yet, statistics reveal that only about 5% of reported cybercrime cases result in a First Information Report (FIR), highlighting a major gap in the initial stage of the justice process. The Indian Cyber Crime Coordination Centre (I4C) reportedly receives over 50,000 complaints each month, a volume that underscores the pressing need for a more efficient and responsive legal infrastructure. Without significant improvements in the speed and efficacy of legal responses, the deterrent effect of legal action remains substantially weakened.

Complexity of Recovery

Intricacies of Fraud Recovery

Recovering from cyber fraud involves a complex and often frustrating process, as explained by Lalit Mohan Sanagavarapu of Quick Heal Technologies. Victims initially must gather sufficient evidence to file a complaint, a step that can itself be quite challenging. Once the complaint is submitted, obtaining a court order to mandate the return of stolen funds adds another layer of complexity due to existing legal processes. The system’s struggle to trace the original source of defrauded money further complicates recovery efforts. Even in cases where victims manage to recover their funds, authorities frequently hold the reclaimed money due to ongoing uncertainties regarding its true origins. This convoluted path to recovery not only prolongs the distress experienced by victims but also discourages others from seeking help.

Challenges in Reporting System

Adding to these recovery challenges is the inefficiency often encountered within the reporting system. Victims trying to reach dedicated cybercrime helplines frequently encounter obstacles, such as long waiting times or inadequate assistance. Additionally, the actual process of filing a cybercrime report can feel cumbersome and bureaucratically overwhelming, leaving victims frustrated and disheartened. This lack of efficiency significantly erodes trust in law enforcement agencies and reduces the likelihood that victims will pursue justice. Improvements in the user-friendliness and responsiveness of cybercrime reporting mechanisms are essential to restoring public confidence and encouraging more individuals to report incidents promptly and accurately.

Need for Enhanced Security Measures

Structured Training Programs for Law Enforcement

India is currently facing a significant surge in cybercrime incidents, stressing the urgent need for improved security measures on a national level. With the growing reliance on digital platforms, the country finds itself increasingly vulnerable to cyberattacks. Victims of these crimes encounter substantial hurdles, not only in reporting the incidents but also in recovering their financial losses and personal data. These challenges are often compounded by the complexity of the crimes and the advanced techniques employed by cybercriminals.

The sophistication of these malicious actors has eroded public digital trust, making it more difficult for law enforcement to tackle the issue effectively. The general public, often lacking adequate cyber literacy, falls prey to these refined tactics, which range from phishing scams to ransomware attacks. As a result, individuals and businesses alike suffer significant financial and data losses.

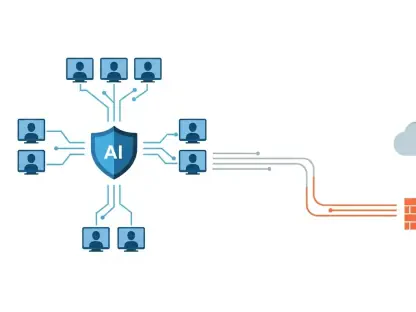

In response to this escalating threat, there is a pressing need for authorities to invest in more robust cybersecurity infrastructure. This includes not only advanced technological defenses but also comprehensive public education campaigns to raise awareness about the risks and safeguards associated with digital activity. Law enforcement agencies must be equipped with the latest tools and training to stay ahead of cybercriminals.

Moreover, collaboration between the government, private sector, and international bodies is essential to develop a cohesive strategy against cybercrime. Only through concerted efforts can India hope to safeguard its digital future and restore public confidence in its online systems.