The manufacturing sector is grappling with a myriad of challenges, but none as pressing as the escalating transportation costs. These costs have surged due to a combination of economic, geopolitical, and regulatory factors, significantly impacting the efficiency and profitability of manufacturing operations. The persistence of these challenges has forced industry leaders to reconsider their logistics strategies to mitigate the impact on their supply chains. This article delves into the various dimensions of this issue, exploring the underlying causes, the impact on the industry, and potential strategies for mitigation.

The Surge in Transportation Costs

Economic and Geopolitical Factors

The global economy has been in a state of flux, with geopolitical tensions and economic uncertainties contributing to the rise in transportation costs. Trade wars, sanctions, and political instability in key regions have disrupted supply chains, leading to increased freight rates. The Freightos Baltic Index (FBX), a key indicator of global shipping costs, remained high at around $5,000 by the end of the third quarter of 2024, significantly above the rates at the end of 2023. These heightened rates are still considerably lower than the pandemic peak of $11,000, but they represent a substantial burden for manufacturing firms that rely on smooth global logistics for their operations.

In addition to trade tensions and sanctions, fluctuating fuel prices and currency exchange rates add another layer of complexity to transportation budgeting. The interplay between these economic factors has left manufacturers scrambling to find cost-effective transportation solutions. The unpredictability of geopolitical events, such as Brexit or trade agreements between superpowers, means manufacturers must constantly adapt to new realities. Consequently, these firms face a moving target in terms of forecasting and managing transportation costs.

Logistical Bottlenecks

Despite expectations of relief from new capacity, logistical bottlenecks have persisted, further driving up transportation costs. Port congestion, labor shortages, and inefficiencies in the logistics network have compounded the problem. Manufacturers are finding it increasingly difficult to move goods efficiently, leading to delays and higher costs. Issues such as labor strikes at major ports, equipment shortages, and insufficient infrastructure investment are significant contributors to these bottlenecks.

In several key global ports, outdated facilities struggle to keep up with the rising volume of trade. This insufficiency leads to extended wait times for ships to unload and reload, causing substantial delays in the supply chain. Moreover, a shortage of skilled labor in the logistics industry exacerbates these problems, as there simply aren’t enough qualified workers to manage the increased workload efficiently. These inefficiencies ultimately trickle down the supply chain, hitting manufacturers with unexpected delays and higher fees, further crimping their operational efficiency.

Regulatory Challenges

Detention and Demurrage (D&D) Charges

Detention and demurrage (D&D) charges, which had normalized by the end of 2023, are once again on the rise due to recent disruptions. The Ocean Shipping Reform Act (OSRA) of 2022 aimed to provide clarity and predictability in D&D charge assessments. However, the implementation of the Federal Maritime Commission’s (FMC) final rule on D&D billing practices, effective from May 28, 2024, has faced opposition from industry players like the World Shipping Council, who argue that the rule is arbitrary and capricious.

These charges are levied when containers are held at ports for longer than allowed, either in handover or demurrage situations. Persistent port congestions and a shortage of transport options make it difficult for manufacturers to retrieve their goods in a timely manner, thereby incurring additional D&D charges. As the industry grapples with these mounting costs, the complaints from shippers, who view these charges as an unfair cost burden, have echoed louder. The contentious rule’s future remains uncertain as industry groups challenge its legality and effectiveness, potentially setting the stage for future regulatory adjustments.

Compliance and Legal Precedents

The regulatory landscape is becoming increasingly complex, with new rules and compliance requirements adding to the burden on manufacturers. The FMC’s comprehensive framework applies to shippers, carriers, customs brokers, truckers, and other supply chain entities, creating a web of regulations that manufacturers must navigate. Legal precedents, such as the U.S. Supreme Court’s Loper Bright decision, are expected to shape the future of transportation regulations, adding another layer of uncertainty.

Manufacturers must now factor in not just the economic cost of goods and shipping, but also the potential legal and compliance costs associated with these new regulations. For example, increased scrutiny on emissions standards can lead to higher costs for cleaner fuels and upgraded equipment, while stricter labor laws can complicate the hiring and retention of necessary logistics personnel. These increasing layers of regulatory compliance create an intricate puzzle for manufacturers to solve, heightening the risk of penalties or legal actions if parts of the complex matrix are neglected.

The Dilemma of Private Fleets

Rising Costs of Private Fleets

In response to severe trucking capacity shortages, some manufacturers have considered operating private fleets. However, the costs associated with private fleets, including driver compensation, insurance, fuel, and maintenance, have risen significantly. The economics of private fleets are becoming increasingly challenging, making it difficult for manufacturers to justify the investment. The spike in fuel prices alone can wreak havoc on budgeting, but adding the cost of new trucks, repair expenses, and inflated insurance premiums makes running a private fleet untenable for many.

Moreover, the rising wages in the truck driving industry, driven by the persistent driver shortage, put additional pressure on private fleet operators. The competition for skilled drivers has forced companies to offer more attractive pay packages and benefits, further squeezing margins. Fuel costs, largely influenced by global oil prices and supply chain disruptions, remain a volatile component, subjecting fleet operators to unpredictable swings. This fragile economic balance can make it difficult for manufacturers to sustain private fleet operations, especially when they must compete with larger logistics firms that can absorb such costs more easily.

Regulatory and Operational Challenges

Operating private fleets comes with its own set of regulatory and operational challenges. Compliance with hours of operation, cargo handling, emissions standards, and the use of Electronic Logging Devices (ELDs) adds complexity to fleet management. Additionally, cybersecurity risks and labor issues, such as driver classification laws and independent contractor regulations, further complicate the operation of private fleets. Ensuring that these complex regulations are met requires a dedicated compliance team, which adds to the overall operational cost.

The necessity of Electronic Logging Devices, mandated to monitor drivers’ hours of service and ensure they comply with federal regulations, represents both an operational necessity and a significant expenditure. While they enhance safety and accountability, the adjustment period required for training drivers and integrating these systems can disrupt regular operations. The legal landscape is also fraught with nuances: changes in driver classification laws can lead to expensive litigation and affect the operational model profoundly. Firms must navigate these legalities meticulously while also putting robust cybersecurity measures in place to protect their logistics data from increasingly sophisticated cyber-attacks.

Hybrid Solutions and Technological Integration

Hybrid Fleet Strategies

To mitigate the risks associated with both private and outsourced fleets, some manufacturers are adopting hybrid solutions. These strategies combine the reliability of private fleets with the flexibility of outsourcing, allowing manufacturers to manage transportation needs more effectively. Hybrid solutions offer a balanced approach, leveraging the strengths of both models to optimize efficiency and cost-effectiveness. This dual approach means manufacturers can allocate resources more dynamically, depending on immediate needs and external logistics conditions, retaining the ability to switch strategies when one becomes less feasible.

Manufacturers can use private fleets for critical and high-margin deliveries where timeliness is non-negotiable, while leveraging outsourced fleets for more routine or less time-sensitive shipments. This tiered approach could potentially manage costs more effectively, ensuring security and reliability without the full-scale investment required for a completely private fleet. Additionally, hybrid models allow manufacturers to adopt variable-cost solutions, offering the flexibility to scale up or down based on market demands, thus maintaining a more resilient logistics structure that can absorb external shocks better.

Technological Advancements and Cybersecurity

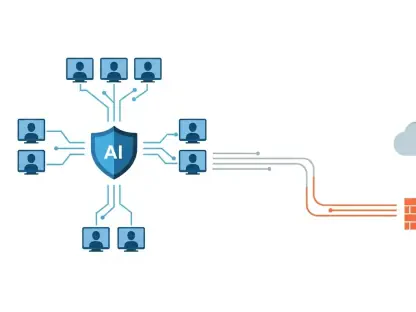

As technology continues to play a crucial role in logistics, manufacturers are increasingly integrating advanced systems into their operations. However, this technological integration brings with it significant cybersecurity risks. Protecting sensitive data and ensuring the security of logistics networks is becoming a top priority for manufacturers, requiring substantial investment in cybersecurity measures. Advanced tracking systems, automated warehouses, and Internet of Things (IoT) devices, while increasing operational efficiency, also open up new vistas for cyber threats.

The complexity of modern logistics networks means even minor breaches can have ripple effects across the entire supply chain, leading to severe disruptions. Manufacturers are investing in robust cybersecurity infrastructure, such as encrypted communication channels, multi-factor authentication systems, and round-the-clock monitoring services to safeguard their operations. However, these cybersecurity measures come at a cost, necessitating a delicate balance between advanced technological integration and managing the escalating expenses associated with comprehensive cybersecurity protocols.

Labor Dynamics and Workforce Management

Complex Labor Laws

The evolving landscape of labor laws, particularly regarding independent contractor status, is adding another layer of complexity to workforce management in the transportation sector. Manufacturers must navigate these legal intricacies to ensure compliance and avoid potential legal disputes. The classification of drivers and the regulations surrounding their employment status are critical issues that require careful attention. Misclassifying drivers can lead to substantial legal penalties and disrupt operations significantly, impacting the overall efficiency of the supply chain.

Additionally, different jurisdictions often have varied and sometimes conflicting labor regulations, which further complicates compliance efforts for manufacturers operating on a global scale. Navigating these complex labor landscapes requires manufacturers to remain agile and well-informed about the latest legislative changes. Continuous training for the HR and compliance teams is becoming a necessity to handle new regulations adequately. Moreover, legal advisories must be consulted regularly to ensure accurate classification of workers, compensation structures, and to preempt any potential disputes that could lead to costly litigations.

Addressing Workforce Shortages

The manufacturing sector faces a host of challenges, but none are as critical as the rising transportation costs. These costs have soared because of a mix of economic, geopolitical, and regulatory factors, profoundly affecting the efficiency and profitability of manufacturing operations. The ongoing nature of these challenges has compelled industry leaders to reassess their logistics strategies to lessen the impact on their supply chains. This article explores the different aspects of this issue, examining the root causes, the effects on the industry, and possible strategies for alleviation.

In particular, the economic factors include increased fuel prices and labor costs, while geopolitical tensions have led to disruptions in global trade routes and supply networks. Regulatory pressures, such as environmental regulations aimed at reducing carbon emissions, also contribute to rising costs. Manufacturers must now navigate these complexities to maintain operational efficiency and profitability. By revamping logistics strategies, embracing technological advancements, and fostering stronger supplier relationships, firms can better manage transportation costs and enhance their overall resilience.